Today we’ll take on the top 5 “deal killers,” and how real estate professionals can avoid these pitfalls.

Buyers and Sellers without professional help kill deals.

We see this on a regular basis, 1) sellers offer their property for sale without consulting a real estate agent, appraiser, or any other tool, 2) a buyer accepts the price, 3) everyone is baffled when the home’s value is much lower than the agree price. Do yourself a favor and call an agent or appraiser and get assistance on the single largest financial transaction you’ll ever make.

Hidden/non-disclosed defects kill deals.

“Disclose, disclose, disclose” - Its the partner in real estate to “Location, location, location.” Failure to disclose issues with the home could lead to a surprise on behalf of the buyer and underwriter - and neither typically react well to this. Further more, failure to disclose can result in legal troubles for the realtor that far exceed the state board’s punishments (As detailed in this article on legal ramifications: https://www.hg.org/legal-articles/violating-the-code-of-ethics-can-get-you-sued-26904). As an agent, if you know it, disclose it to all the parties. Inman lists failure to disclose as the #1 way that real estate agents get sued: https://www.inman.com/2015/08/25/10-most-common-ways-real-estate-agents-get-sued/

An agent can’t know everything, however, its your job to investigate, not overlook. Courts increasingly recognize the expertise that agents and brokers claim, and are holding them to that level of accountability.

Sales agreements above market values kill deals, and reputations.

Pricing properties takes years of experience. Sadly, this is not a skill that the current real estate education system emphasizes. A newly minted real estate agent has received 0 mandatory hours of education/experience in home valuation. Contrast that with a newly minted appraiser, who in Pennsylvania has a mandatory minimum of 200 hours of education plus a minimum of 1500 hours of experience in home valuation. We hope that in the future new agents will have many more opportunities opened up to them in this regard.

The CMA that an agent performs is vital in seeing a deal through to consummation and developing a good reputation. Priced too low and the property may sell, but you may have just guaranteed that no one in that family will ever use you again. Priced far too high, and the property may sit on the market for so long that the seller moves on to someone else. Three steps to a good CMA:

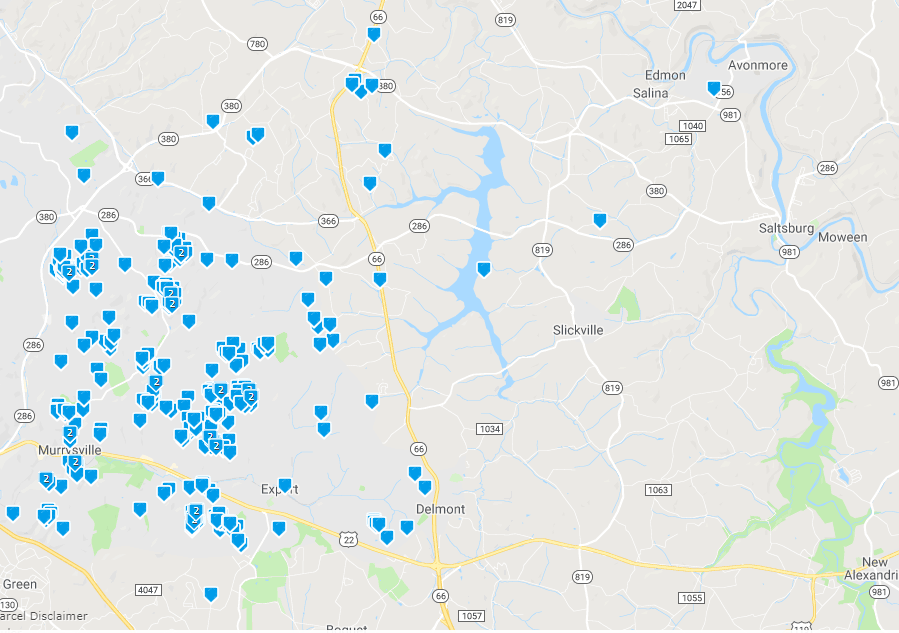

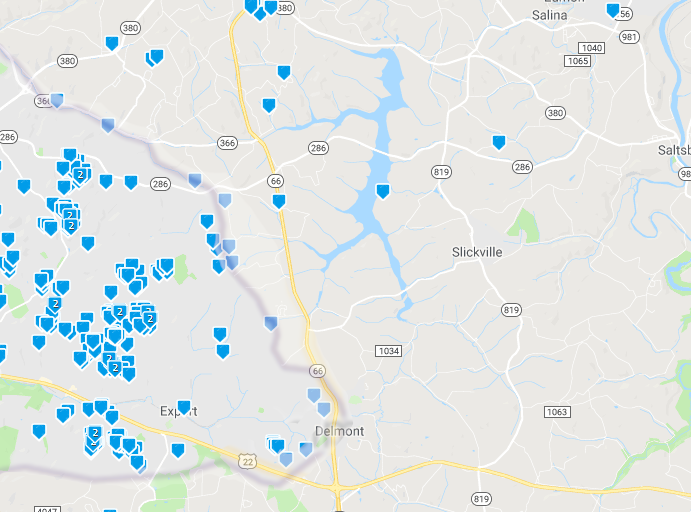

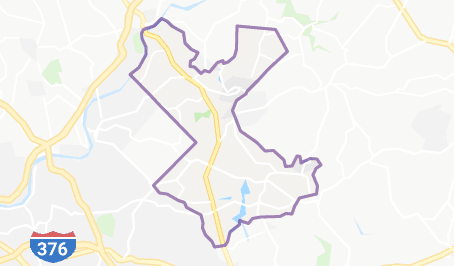

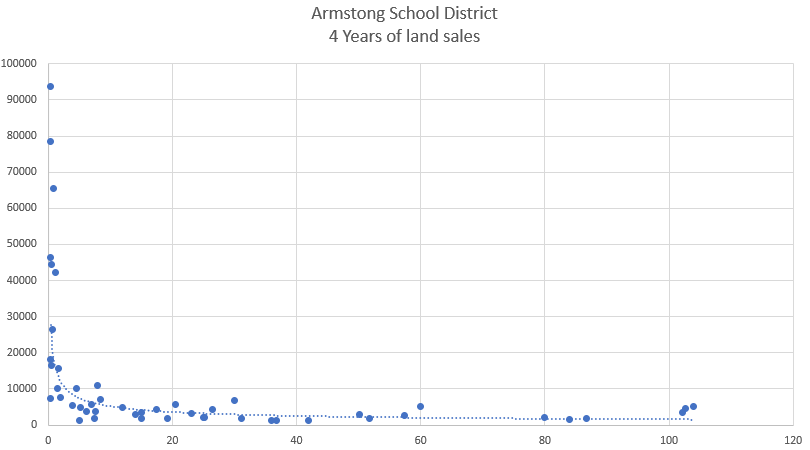

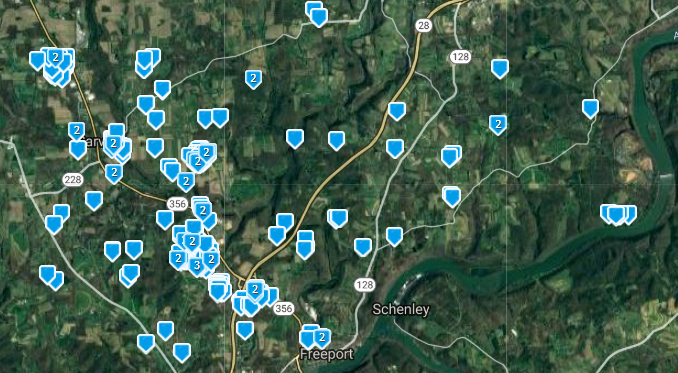

Use sales primarily over active listings. These tell you what the market has accepted - not just what sellers want. In the last three years in Indiana County 50% of listings expired without a sale - over that same time real estate prices were holding steady, but listing prices were being driven higher. Now, after three years of this trend, home values are falling in the more rural areas of the county. Chasing the latest listing prices will often result in a waste of your time at best, and at worst a deal that falls through because the market value doesn’t support the listing price.

Use the best sales available. Go back in time 3 years in the immediate neighborhood to find the perfect comparable, and allow that to inform your search for more recent sales. Find a few sales that are a little better/worse in every facet (size, lot, condition, quality, basement, parking, etc) and allow that to begin to form a range that your seller/buyer can fall in.

Get advice. Some properties are unique - we see them all of the time, and they are hard to value. First, use your brokers experience to help you - they’ve got the title for a reason. However, when in doubt, we have brokers and agents who call us for our expertise in these areas. While USPAP doesn’t allow us to discuss value with someone involved in a assignment we are working on, we can certainly give advice on everything else that we aren’t working on. Further, sometimes a restricted use appraisal, which is often cheaper and shorter than a full appraisal, may be called for to determine a list/offer price for particularly complex properties - saving you months of work/headaches for a small fee.