Appraisers evaluate hypothetical houses every day - let me explain. Here are some of the examples:

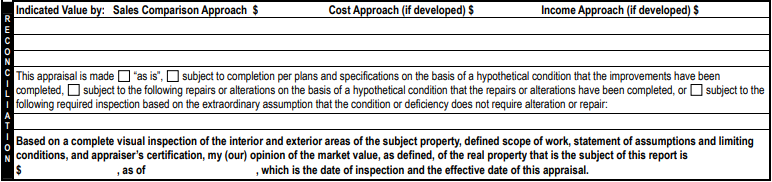

New construction - we appraise what the home will be worth upon completion as if it was built at the time we write our report, using the data that is given to us. Without this valuable tool, banks wouldn’t be able to make informed investment decisions and homeowners would be left at the mercy of overpriced builders.

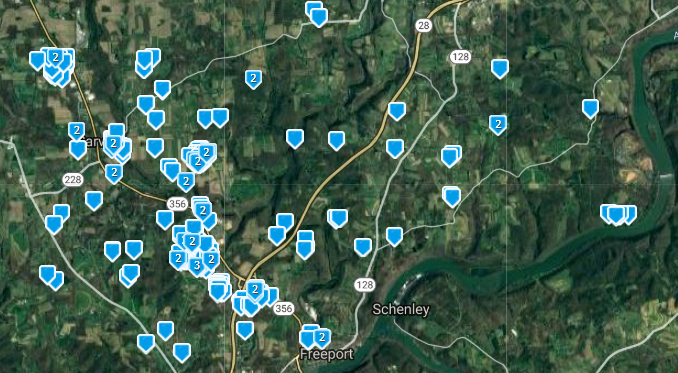

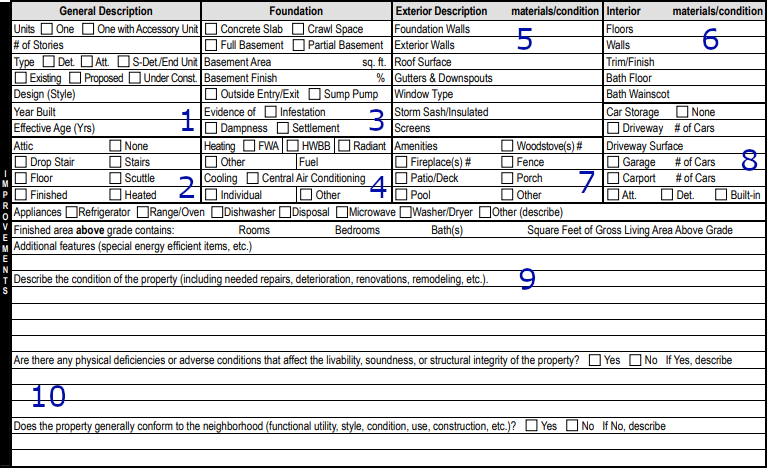

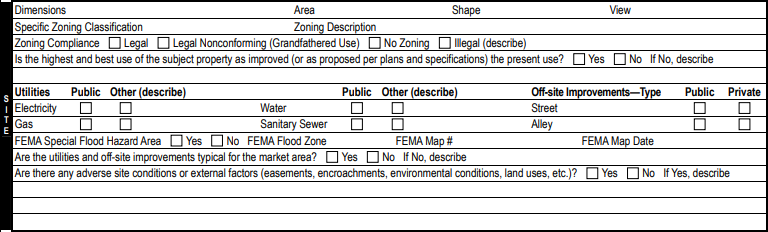

Exterior-only appraisals - everyday appraisers are on the streets inspecting properties from the street, or “Drive-bys” as their called for short. These are most often used by lenders considering foreclosure. They want to know if their asset is still in good shape and worth enough to cover the remaining loan. In this instance, the appraiser assumes that the interior of the home is in similar condition/quality to the exterior. We then use public records, prior multi-list data, and other sources to determine the value of the hypothetical house that all of that information tells us.

Regular appraisals - even when the appraiser has all the facts, and inspects the property themselves, there are things that the appraiser has to assume. We assume that the couch in the living room or the bedroom dresser isn’t hiding a gaping hole - we never move the furniture to check. We assume that what we see is consistent with what we can’t see.

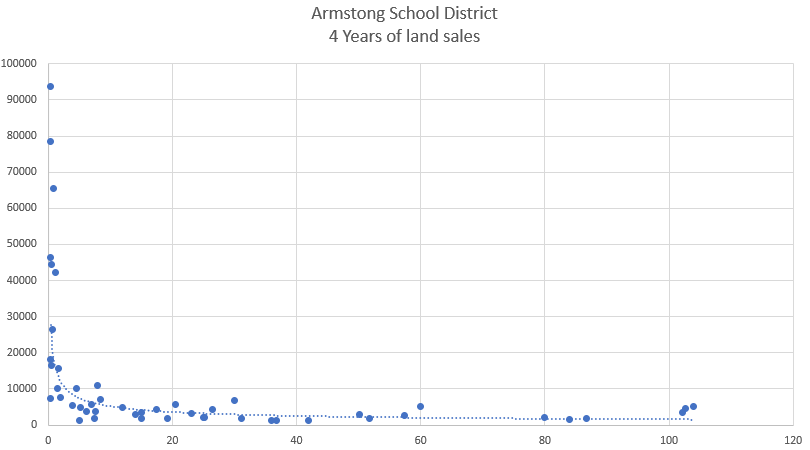

All of these have their place, and are needed - but they also have a risk. An appraiser is always evaluating some degree of a “Hypothetical House,” the house that they can see, and assuming the rest. What if the assumption is wrong? Of the above, the most likely to be incorrect as to the real value of the “Real Home” is the drive by - the more assumptions that have to be employed, the more potential error is inserted into the system.

Appraisers play a part in the overall health of the real estate system.

Real estate agents - help to inform and educate buyers and sellers

Loan officers - help to ensure that the borrower is fit to secure a loan

Home inspectors - help to ensure that the property is safe and secure

Appraisers - help to ensure that the dwelling is fit to lien for the loan

Take any cog out of this machine, and the overall health suffers. But that is exactly what we see beginning to happen, and all in the name of making more money, faster.

The current trend is towards appraisers not inspecting the property at all. They are being given a report prepared by another party, without any necessary education on how to inspect a house. Appraisers are then expected to make value determinations based on that information. Can they produce credible results? Only as credible as the inspection, but yes. If this is the move that is coming to the real estate industry, then these inspectors need to be held to high standards. An appraiser trainee must train for a minimum of 300 hours and have 75 hours of education before they can inspect a home on their own, and only with the permission of their mentor. With this new move, a dangerous step is being taken back towards the early 2000’s where appraisers only had to inspect from the street… and this had a direct contribution to the housing collapse of 2008 (along with massive mortgage fraud on the part of the banks pushing for more money, faster… does anyone hear an echo?)

The further appraisals are removed from “Real Houses” and pushed towards valuing “Hypothetical Houses” the further we will move from actual “Real Estate Markets” and further towards “Hypothetical Real Estate Markets.” When these two collide, trillions of dollars go up in smoke in an instant.