How much is an acre worth? Well, it depends…

Is it river front or next to a nuclear waste site?

Is it one parcel or divided by power lines/major highway?

Is it sloped like a cliff or is it flat?

Is it a normal shaped lot or is it a foot wide and two hundred feet deep?

(Town and Country has appraised all of the above, sometimes multiple at once)

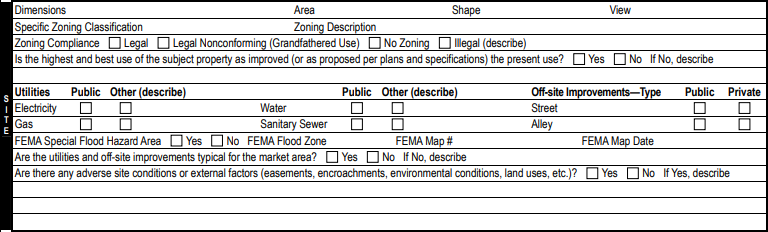

The location of the subject specifically is addressed in the site section. This includes not only the lot size, but the other factors that can make much more impact. One of the greatest impacts on value is the Zoning. If the subject is a 2 acre parcel with a multifamily dwelling and zoning only allows single family dwellings, there is a huge problem (we have come across this scenario as well).

The appraisal process in this section requires familiarity/research of the area’s external factors, municipal utilities, zoning, topography, flood zones, and any covenants and restrictions that may limit the usage of the property - none of which are as easy as merely checking boxes.

Highest and Best Use Analysis

A property must be appraised in terms of its highest and best use. There are four tests that must be applied to a property, in order:

Legal permissibility

Physical possibility

Financial feasibility

Highest profitability

Steps three and four cannot be determined until the first two steps are analyzed. Most of the time legal permissibility and physical possibility are easy questions of zoning and building requirements, however, when they are not, they can slow the appraisal process down considerably. Sadly, sometimes an appraiser can wait for weeks for the local code enforcement officer to inform them of the legal permissibility of the subject under consideration. When homes are built that fail tests one and two, huge problems can occur.

In this case (http://massrealestatelawblog.com/2012/02/21/a-different-type-of-tear-down-court-orders-million-dollar-marlblehead-manse-demolished-for-zoning-violation/) the failure of the home to pass the first two tests cost millions of dollars and 16 years of legal problems. This is why appraisers in every appraisal must begin the process with step 1 and 2 of the HBU analysis and not proceed until they are confident that these criteria are met. It may slow the appraisal process down, but its better than a lawsuit against the appraiser and real estate agents for not disclosing this information to the buyer years down the road.

These two short lines in the Site Section of the report reflect a great deal of analysis behind the scenes, as is the case with so much on the URAR 1004. When you read through these reports, reflect on the fact that you are being given a 15 minute read through of analysis that took hours to develop, and something that can’t be merely replaced by an algorithm.

Real estate valuation is not a “by the numbers” only process. This is the fatal flaw in the current move towards algorithms.