Today we finally arrive at the section of the appraisal that everyone jumps to first: The section that contains the opinion of value. You can find the full form here: https://www.fanniemae.com/content/guide_form/1004.pdf

Before we get to how the opinion of value is determined, lets address a few different conditions that the appraisal could be made according to, at the lenders request or per certain standards. A report can be made:

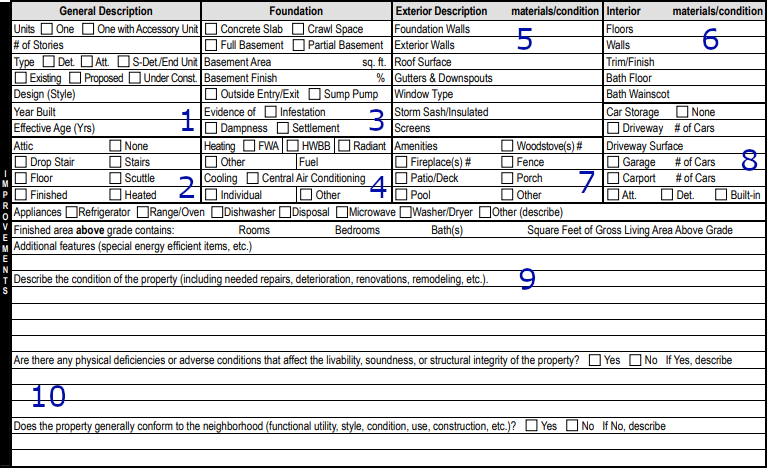

“As Is” - this means the property is appraised as it is, on the day of inspection. While sellers may put “As is” in their listing, IF they accept an FHA/VA/USDA or Fannie Mae backed conventional loan as part of an offer, they are accepting that the property MUST meet the minimum standards required to qualify for these loans. The appraiser must complete the appraisal per the standards and guidelines that the client/lender/government impose and in some instances, cannot be completed “as-is”.

Subject to completion per plans - these are common among new construction, where the appraiser values the property as if it were built on the day of inspection of the land per builder specifications. The appraiser must have those plans and the materials list in order to value the property credibly.

Subject to repairs - If a deficiency is noted in the report that does not allow the home to secure a loan (chipping paint on older homes for FHA/USDA/VA, exposed wiring on any government backed loan or conventional, leaking roof, etc) then the report will be made subject to those repairs being completed. That is to say, as if the repairs had already been made the day of inspection. (FHA/USDA minimum property requirements are located in section II.D.3.a-q of the HUD 4000.1 available here: https://www.hud.gov/program_offices/housing/sfh/handbook_4000-1)

Subject to inspections - while appraisers can identify many issues that would raise red flags in the loan process, there are many areas of expertise that we do not have. A horizontal crack in a basement wall can be a sign of settlement and future problems, however, the cause, severity and cure are not within the appraisers expertise. An appraiser can note a ceiling that appears to have water damage, but the cause and cure are the expertise of a plumber or roofer. These items are called out for inspection by a qualified professional. The professional then gives their opinion to the lender as to any future need of repair, and the lender has the choice as to how to proceed.

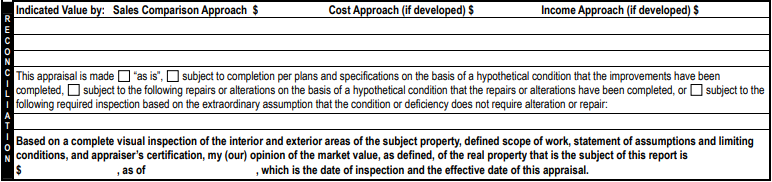

Reconciliation/Opinion of value

After all of this data gathering, and data analysis, and dozens of items that haven’t been addressed here (Highest and best use analysis, comparable selection, statistical analysis, sensitivity analysis, survey analysis, depreciated cost analysis, etc), the appraiser has a group of numbers that they have to make sense of.

In an ideal world, the comparables would all adjust to the same number, and the cost and income approaches would all present the same number… but that never happens. For the sales comparison grid, weight is given to each sale as to the relevance of those sales in determining sales comparison approach to value. This weight is given based on a variety of factors, but most typically are based on the overall similarity of appeal of a comparable to the subject, similar locations, similar amenities, or close groupings of value indicators.

Finally, we have three numbers - The Sales Comparison Indicator, Cost Approach Indicator and Income Approach Indicator. If the appraiser feels in their analysis that one approach does not produce a credible result in this instance, that approach can be excluded and explained as to why. The appraiser then weights these approaches to value in determining the final opinion of value, giving weight to the indicators that they feel are most credible.

Some say, “An appraisal is just an Opinion of value.” However, after this 10 part series we hope that you see that the opinion of value that is developed is more like a Doctor’s opinion of your illness than just something plucked out of the air. No other party in the real estate transaction is held to such a high standard as the appraiser when it comes to their “opinion.” No other party has as much education in valuation, or required experience necessary to be licensed to develop these opinions. In fact, it is illegal for anyone other than a Licensed Appraiser to use the words, “Market value” in connection with their opinion of value.

A closing thought

Appraisal standards (USPAP) require that we communicate only with our client, and the client is the party that engages us for the appraisal. So, in most cases, neither the homeowner OR the lender is our client - but rather a third party. If you have questions for the appraiser in these cases, the ONLY thing they can tell you is, “Please pass your question along to your lender and they will pass it along to me.”

This can feel like the “run around,” and many appraisers don’t like it, but sadly, it is currently what we must do. PLEASE, if you have a question during the loan process, talk to your loan officer. This person is there for that reason, and can answer many questions, and if not they can pass your question along to the appropriate parties, including the appraiser.